British imperialism, the City of London and Brexit

- By Michael Roberts and Heiko Khoo

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, February 28, 2016

E-mail China.org.cn, February 28, 2016

|

|

|

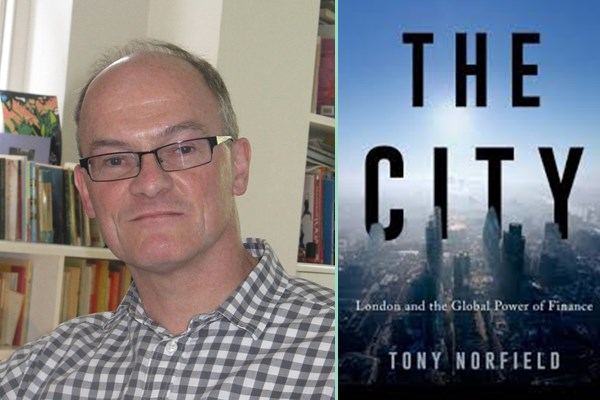

Tony Norfield and his book The City |

Tony Norfield worked for ten years as the executive director and global head of foreign exchange for a major European bank. He has just published The City (The City - London and the global power of finance, by Tony Norfield, is published by Verso Books), a book on British imperialism and global finance in the 21st century.

Norfield's insights into the nature of capitalism's modern financial systems emphasize that finance and production are increasingly inseparable - "they are close partners in exploitation." He rejects any categorical division between "bad" finance and "good" productive capital - as this misreads the nature of imperialism and its financial centers.

Britain is second only to the U.S. in the global significance of its financial sector and in areas like foreign currency trading it leads. Britain has the second largest stock of foreign direct investment (FDI) - nearly $2trn - equivalent to 30 percent of U.K. GDP. Of the top 500 global companies, the U.K. was second only to the U.S. with 34 companies. The U.K. has six financial institutions in the top 50, compared to the U.S. with ten. And U.K. bank assets are four times U.K. GDP, the highest ratio in the world after Switzerland and Luxembourg.

London has advantages as a financial center: its time zone, the English language, and supportive professional services. This contrasts to the relative weakness of U.S. money markets and banks.

After 1945 Britain's financial sector retained its global status at the same time as its manufacturing base diminished. The Eurodollar market in the 1960s and the "Big Bang" of the 1980s, when U.S. banks and foreign banks were allowed to operate without restriction, preserved London's pre-eminence.

For Norfield, financial privilege is a form of economic power. It enables wealthy countries to draw on resources and value created elsewhere in the world. A small number of such imperialist countries dominate world markets through multi-national corporations engaged in production, service provision and finance.

Today 147 companies exercise "networked control" over world trade. And European and U.S. companies continue to dominate through global finance and corporate power. Indeed: the Asian "production miracle" of the last 30 years barely dents this power.

In the modern world economy, finance is intertwined with productive capital. So corporations in nation states often reap huge revenue from income abroad. Such revenue from abroad is worth $3bln a day to U.S. corporations - more than the annual GDP of Switzerland.

Norfield weaves facts about modern imperialism together with a Marxist analysis of the role of finance capital. He points out that banks appear to make money beget money - a progress "completely independent of capitalist production."

However, he says that money dealing and commercial banking are not simply "parasitic" as they act as essential lubricants to the wheels of capitalist production. But interest-bearing capital (money to make money) is parasitic as it reduces the profits of productive capital. And imperialism is globalized interest-bearing capital.

Karl Marx associated the idea of making money out of money with his term "fictitious capital:" a claim on the value-creating assets of companies and their future earnings.

Fictitious capital is a key feature of modern capitalism and imperialism, and many sectors of the economy are based on fictitious capital. In addition the nation state plays a key role in supporting and expanding monopoly capital and imperialist power.

Go to Forum >>0 Comment(s)