Say no to unwritten investment restrictions

0 Comment(s)

0 Comment(s) Print

Print E-mail Beijing Review, April 15, 2016

E-mail Beijing Review, April 15, 2016

|

|

|

[By Li Shigong / Beijing Review] |

Recently, the Committee on Foreign Investment in the United States (CFIUS) stopped two Chinese investments. In January, CFIUS blocked the $3.3-billion sale of Philips' lighting unit to a Chinese consortium. In February, China's Unisplendour Corp. Ltd. terminated a deal to acquire a 15-percent stake for $3.8 billion in Western Digital Corp. following a decision by CFIUS to conduct an investigation into the purchase. It is safe to say that CFIUS is the "No.1 killer" of Chinese investments in the United States.

CFIUS is an inter-agency committee authorized to review foreign investment, chaired by the U.S. secretary of the treasury and consisting of members including secretaries of justice, homeland security, commerce, defense, state and energy, and U.S. trade representative. It is an organization that makes investigations in order to determine the so-called impact of such transactions on national security in the United States.

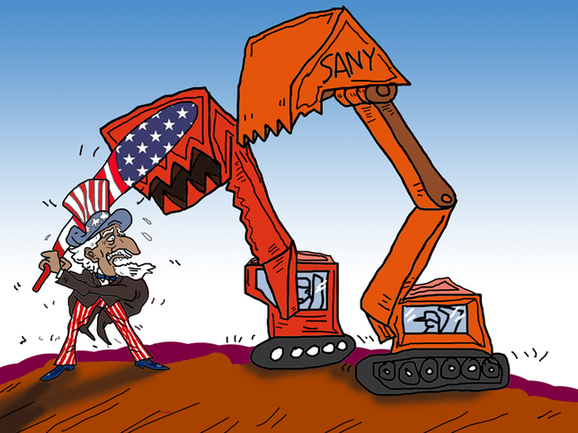

There are other examples of blocked bids such as Chinese oil giant CNOOC's failed acquisition of the U.S. energy company Unocal in 2005 and Chinese machinery maker Sany Group's purchase of a U.S. wind farm project, which involved a lengthy legal battle from 2012 to 2015. Chinese chemical maker ChemChina's February deal to buy Swiss pesticide giant Syngenta for $43 billion also aroused concern from U.S. law makers, who believed that the deal would pose food safety or national security risks. The possibility that CFIUS may step in cannot be ruled out.

Chinese telecom equipment maker Huawei Technologies has often been the target of CFIUS investigations. In 2008, Huawei and Bain Capital's deal to purchase U.S. digital electronics manufacturer 3Com was banned by CFIUS for its alleged threat to U.S. national security. In 2010, Huawei's bidding for a network upgrade operation for U.S. telecom company Sprint Nextel also failed out of national security reasons.

In 2011, due to opposition from CFIUS, Huawei also withdrew its agreement to buy the assets of 3Leaf Systems, which offers server virtualization solutions to the enterprise data centers, for a mere $2 million. In the 3Leaf case, Huawei was irritated and criticized CFIUS for treating it unfairly.

As a result of frequent CFIUS interventions, one could see the potential for discrimination against investments from China via unwritten rules.

Go to Forum >>0 Comment(s)