China needs more foreign investment

- By Zhang Lijuan

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, August 24, 2017

E-mail China.org.cn, August 24, 2017

Foreign Direct Investment (FDI) has played an essential role in the success of China's open-door policy since the late 1970s. FDI in manufacturing, in particular, has greatly contributed to China's economic growth over the past thirty years.

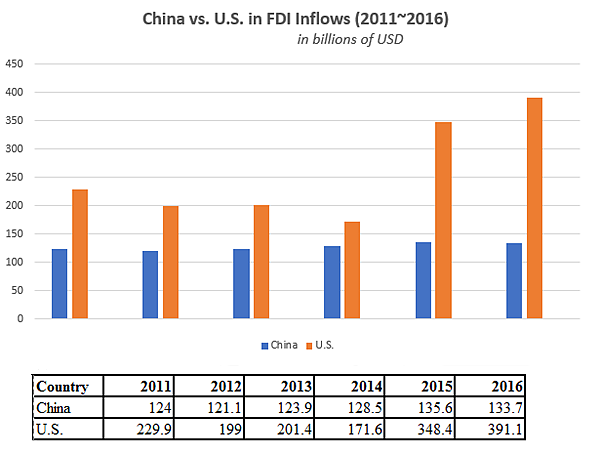

However, in 2016, China's FDI inflow dropped to $133.7 billion from $135.6 billion in 2015, according to the World Investment Report 2017 released by the United Nations Conference on Trade and Development (UNCTAD). The United States continues to hold the largest amount of FDI in the world (See chart below).

|

|

|

Source: World Investment Report 2017, United Nations Conference on Trade and Development. [Graph by China.org.cn] |

According to the UNCTAD data, China's FDI inflow amounted to about 7.8 percent of the world total of FDI inflows in 2011, and continues to be a top recipient. In 2016, China attracted 7.6 percent of the total FDI, while the U.S. share of worldwide investment inflows reached 22.4 percent.

As FDI plays an important role in today's open economy by creating jobs, driving growth, and promoting innovation, it is understandable that China has made great efforts in making its policy attractive to FDI inflows.

As part of the key findings in the U.S.-China Business Council 2016 Membership Survey, the key concerns for multinational enterprises (MNEs) investing in China include policy uncertainty and the business environment.

While U.S. companies are looking forward to a high-standard U.S.-China Bilateral Investment Treaty (BIT), MNEs are particularly sensitive to issues such as the rule of law, further market access, intellectual property rights (IPR) protection, and concerns over level-playing fields. The recently released policy by China's State Council demonstrates China's timely initiative to establish a sound rule of law as well as a level playing field for foreign direct investments to China.

Market access has been a top-priority issue for many years. A shorter negative list for foreign investment as implemented in the pilot free-trade zones is getting under way, which should open more areas to FDI, including sectors previously protected such as renewable-energy vehicle manufacturing, aircraft maintenance, and railway passenger transportation.

IPR concerns have been a long-lasting issue involving bilateral, regional and multilateral negotiations. More and more, IPR issue has become a strategic concern for developed economies, which partially explains the Trump administration's application of Section 301 of the U.S. Trade Act of 1974 to investigate China's trade practices, a harmful step for bilateral relations but an alert to China's policymakers. Therefore, the State Council pledges to improve the protection of intellectual property rights and raise the competitiveness of R&D environment.

The investment environment matters also. As agreed by American companies that participated in the U.S.-China Business Council (USCBC) survey, the biggest driver of reduced confidence for American businesses in China is the policy and regulatory environment. The Chinese government also sees it as a serious threat to FDI inflows and attracting more MNEs to China.

Today, China has become a key player in the 21st century rules of global trade. Major issues on the 21st century trade agenda, such as data trade, IPR, and environmental standards, will have to be addressed too.

From the manufacturing industry perspective, China has been aiming to prepare its large capacity manufacturing industry to be successful in the coming digital era. As stated in the "Made in China 2025," intelligent manufacturing and green production requires upgrading China's capability in manufacturing, which is why keeping China as an attractive destination for potential global investment is critical.

China's new normal economy is progressing along with fast growing digital and service sectors, which indeed creates great opportunities for MNEs in the Chinese market. Attracting MNEs in the past required general trade and investment policies, but for digital MNEs, according to the UNCTAD report, they are expanding at a dramatically faster rate than other multinationals and therefore deserve better rule of law protection and a wider market. This trend, in turn, will drive a nation's economy into a new phase of globalization and a new pattern of growth.

USCBC estimates that China is a $400 billion market for U.S. companies, and 91 percent of American companies in China say that Chinese growth prospects are the same or better than those of other emerging markets. The continued investment by MNEs into China can only be ensured by a more transparent regulatory environment and competitive institutional framework.

To create attractive investment environments in the world by announcing a new set of policy initiatives, the Chinese government is now on the right track.

As the United States and China have been working together in BIT negotiations, let us hope that the details of further opening the market and upgrading FDI rules and regulations will become a policy engine for attracting more FDI to China. As long as the Chinese economy grows, the world benefits.

The author is a columnist with China.org.cn. For more information please visit: http://www.china.org.cn/opinion/zhanglijuan.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.

Go to Forum >>0 Comment(s)