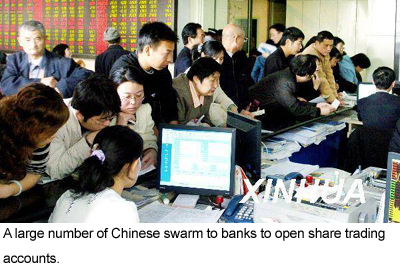

Since the end of 2006, Chinese share prices have more than doubled. The market value of these shares accounted for less than 50 percent of the gross domestic products (GDP) in 2005 but currently it has surpassed the entire GDP. Meanwhile,

shareholders have increased by tens of millions, with economic and financial issues popular topics among the general public. Financial terms, such as liquidity and CPI, have become familiar to ordinary people. The byproducts of wealth are noticeable almost everywhere throughout society.

On October 20, 2007, Alibaba.com, a mainland business-to-business (B2B) dealer, issued IPOs on the Hong Kong Exchanges and Clearing Limited (HKEx) exchange. Share buyers showed great enthusiasm for this new stock and swarmed into the Hong Kong bourse, jamming the trade systems of several online banks, securities firms and HKEx. That day, Alibaba.com raised approximately US$1.7 billion, second to the US$1.9 billion that Google raised in 2003. Thus the company, which had been a small venture with as few as 18 staff members 8 years before, became overnight one of the world's top 6 Internet enterprises. Due to the IPO issuing, some 1,000 out of the 4,900 employees who held the company's shares suddenly owned over HK$1 million each based on the market value of Alibaba's share. China's largest bunch of wealthy men appeared, a financial journalist commented afterwards.

Incredibly enough, some children have also benefited from the bullish stock market. The Bank of Beijing's IPO issuing in September 2007 made Zhen Yuxuan, a 10-year old, a millionaire. Besides this child, the Bank of Beijing has another 83 juvenile shareholders who have become rich from the bank's listing.

The rich in China are quickly getting richer. In 2007, 66 Chinese billionaires entered Forbes magazine's "China rich list", a huge surge from the 15 listed in 2006. According to Rupert Hoogewerf, well-known for his annual Hurun Rich List, the 800 rich Chinese on 2007 Hurun Rich List had average wealth worth US$562 million, up more than one-fold from the 2006 figure. There were 106 billionaires on the list in 2007, an enormous increase from the mere 14 in 2006. Currently, China, following the US, ranks second in the world in terms of the number of billionaires. But when China's first rich list was introduced in 1999, there was only one billionaire – Rong Yiren.

Mr. Hoogewerf said that the stories about how the newcomers to the rich list earned multi-billion dollar assets reflects the amazing scale and variation of commercial opportunities in China. He believed that the stories of those acquiring great wealth and considerable achievement are actually the stories of modern China. He viewed 2007 as the transition year for civilian wealth accumulation because this year has seen a larger number of private-owned enterprises, appearing as mature entities after decades of growth, swarming into the capital market.

The wealth accumulation has made the growth of consumption slower than that of investment and exports. But China, to the multi-national companies in various fields ranging from auto-making and IT to fast food, is the most promising business land because these companies can find incredibly large and rapidly growing markets. IT and automobile businesses are excellent examples. In 2003, Chinese IT business accounted for 30.8 percent of the entire IT market of the Asia-Pacific region (excluding Japan), but this percentage is expected to increase to 38 percent in 2008. This growth rate is much higher than the world's average level. The vehicle population in China is expected to hit 8.5 million in 2007, increasing 30 percent from that last year.

Rich Chinese have made the cosmetic business, a formerly unpromising trade, experience an unprecedented boom. In 2007, the cosmetic market on the Chinese mainland ranked second in Asia and eighth in the world. A 2007 survey on the Chinese consumption market predicted that China would become the biggest and fastest growing luxury market in Asia within the next five years. Cosmetic sales are expected to reach 80 billion yuan by 2010.

On December 10 2007, the Morgan Stanley Asia Chairman commented that the Chinese economy had never grown so well and fast as it did in the last five years. During the last three decades, the Chinese economy was growing annually at an amazing rate, 9.5 percent. In 2003, China took the place of the US as the most popular foreign direct investment destination in the world. Now China dominates not only the labor-intensive manufacturing industries but also the consumer electronic product manufacturing industries. In addition, the country has made great breakthroughs in the manufacturing of computer chips, automobiles and plane engines, among many other items.

According to an economist, Chinese exports made up 38 percent of the GDP as of 2005. In the US and India, exports only accounted for 10 percent and 21 percent of the GDP respectively. Moreover, the investment in China accounted for 45 percent of the GDP as of 2006, the biggest percentage that has ever appeared in an economy in the world's history. Therefore, it is reasonable to say that China has become the primary engine of the global economy and will also become the largest trading country in the world.

China's booming economy can help offset the negative impacts of the US's falling demands and add potential momentum to the global economy. "Reducing the external imbalance may become an important contribution from China to world growth, if a sharper than expected US slowdown were to affect this adversely," says Bert Hofman, lead economist for China at the World Bank.

(China.org.cn by Pang Li, January 2, 2008)