The G20 summit from China to Mars

- By Heiko Khoo and Michael Roberts

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, September 9, 2016

E-mail China.org.cn, September 9, 2016

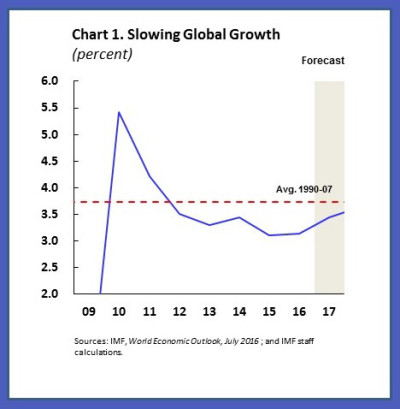

When leaders of the top 20 economies in the world (the G20) met in Hangzhou, China, they all agreed the global economy is still in trouble. The IMF calculates 2016 will be the fifth consecutive year in which global growth will be below the 3.7 percent average recorded from 1990 to 2007.

It says: "High frequency data points to softer growth this year, especially in G20 advanced economies, while the performance of emerging markets is more mixed."

It goes on to say that, "The global outlook remains subdued, with unfavorable longer-term growth dynamics and domestic income disparities […] The decline in investment, exacerbated by private sector debt and financial sector balance sheet issues [hangs over] many countries; low productivity growth trends, and demographic factors weigh on long-term growth prospects, further reducing incentives for investment despite record-low interest rates.

"A period of low growth that has bypassed many low-income earners has raised anxiety about globalization and worsened the political climate for reform."

IMF chief, Christine Lagarde, also blogged that, "Weak global growth that interacts with rising inequality is feeding a political climate in which reforms stall and countries resort to inward-looking policies."

Low growth, high debt, weak productivity and rising inequality -- that's the story of the world economy since 2009.

So what did the IMF suggest to the G20 participants as way out? First, more support measures to promote "demand," although it should be noted that current monetary policy (zero or negative interest rates and printing more money) are not working. Hence, it was "time to boost public investment and upgrade infrastructure."

The IMF insists the world needs more neo-liberal type "structural reforms," like deregulation of labor and product markets, reducing corporate pension schemes, etc. in order to boost profitability.

However, there should also be less inequality through higher basic benefits and increased education for low-wage earners. For the IMF, the answer is more globalization, more world trade, and more neo-liberal reforms, as well as less inequality -- a rather unlikely combination of irreconcilable policies!

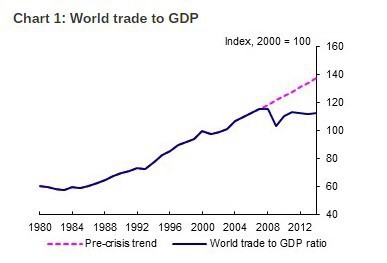

This was one idea that dominated the G20 meeting, as the growth in world trade has been dismal ever since 2009.

World capitalism led by America confronts growing anger at "globalization" (free trade of goods, services and capital flows for big business). The World Trade Organization's trade agreements have stopped and regional mega-deals like TTP and TTIP are in serious jeopardy. In addition, governments are under pressure to block further deals or reverse them, as protectionist ideas gain ground.

China is particularly worried because global trade growth is vital to its continued high export levels and its investment-led economic model. Chinese President Xi Jinping called for wider trade and investment. "We should turn the G20 into an action team, instead of a talk shop," he said at the summit.

Earlier this year, many mainstream economists argued China and other "emerging" economies would drag the rest of the world down; however, we disagreed at the time. The optimism for recovery then switched to the U.S. and Europe.

However, the U.S. economy has slowed down even more and Europe has not revived. So hope for stronger growth has swung back to the major emerging economies. The U.K. accountancy firm Deloitte says: "The downward trend for emerging market activity seems to have run its course. Growth is widely expected to accelerate in 2017. India is forecast to grow by 7.6 percent next year, the fastest rate of growth among any major economy. Brazil and Russia are likely to emerge from recession. Chinese growth is expected to ease, but, at a forecast 6.2 percent in 2017, would still be far higher than the global average. Crucially, the risk of a Chinese 'hard landing' has eased."

One of the biggest policy proposals being mooted is for governments to raise infrastructure spending (roads, rail, bridges, power stations, telecoms etc.) as an engine of growth. Governments trying to cut their budget deficits by reduced spending generally have ignored this advice.

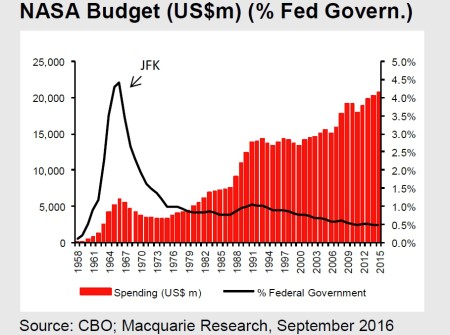

The latest call has come from the economists of the Australian investment outfit, Macquarie. Why not colonize Mars? "It is not as crazy as it sounds," wrote Viktor Shvets and Chetan Seth from the Macquarie global equities team.

"A giant Mars colonization program would create a vast, capital-intensive industry spanning the globe, creating jobs, and addressing the global economy's productivity problem."

As the world economy is not growing fast enough because of "declining returns on investment", we need to start a huge government program to colonize Mars, similar to the American space program of the 1960s under President Kennedy that led to landing on the Moon.

But these economists don't call for an investment program to improve the lives of the people on Earth; or to help solve environmental disasters; or boost education, health and basic infrastructure in the poorest countries here. Apparently this is not as useful (profitable) as investing in Mars!

The Macquarie solution is the ultimate in Keynesian economic policy, which maintains that there is plenty of capital available but not enough "investment opportunities" due to a lack of demand. So, war or space can offer a way out.

However, Marxist economists suggest that productive investment is sluggish not because of "too much capital and low demand" but because there is too little surplus value or profitability coming from productive capital.

And low profitability cannot be overcome by means of government spending on a journey to Mars. In the 1960s, the U.S. space program was affordable, because there was high (not low) profitability in the capitalist sector.

Hence, unproductive expenditure, which no doubt did develop new technology and employment for many, was affordable. The opposite is now true. There is no way to overcome the crisis on Earth by investment in Mars.

Michael Roberts is a London based Marxist economist working in London's financial services industry. He published the "The Great Recession" in 2008 and "Essays on Inequality" in 2014.

Heiko Khoo is a columnist with China.org.cn. For more information please visit:

http://www.china.org.cn/opinion/heikokhoo.htm

Opinion article reflected the views of their authors, not necessarily those of China.org.cn.

Go to Forum >>0 Comment(s)