The Fed silences Obama's currency rhetoric

- By Zhang Guoqing

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, November 22, 2010

E-mail

China.org.cn, November 22, 2010

|

|

|

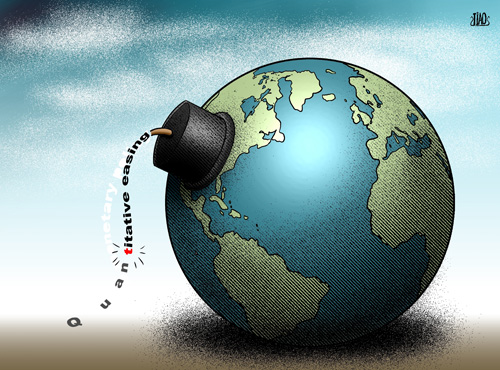

Economic time bomb [By Jiao Haiyang/China.org.cn] |

For US President Barack Obama, the G20 Summit in Seoul was embarrassing. Not only did his carefully designed plan to assemble an overwhelming coalition on the RMB issue fall through, but he himself was subject to a wave of innuendo from all sides.

And he has only the Federal Reserve to blame.

The President was full of expectations for Seoul. He needed some good publicity after the Democrats' debacle in the mid-term elections. He also wanted to step up the pressure on China for a rapid appreciation of its currency.

But even before his arrival in Seoul, many countries had begun to criticize the Fed for flooding banks with excess liquidity with its policy of quantitative easing. Against this background, his criticisms of strong exporters like China and Germany met with something approaching a collective counterattack.

The United States wanted to include the phrase "to avoid competitive undervaluation of currencies" in the G20 declaration, but what appeared in the final version was "to avoid competitive devaluation of currencies". This was an indirect condemnation of the United States. It showed the other 19 members of the G20 straightforwardly refused to back the US in pressuring China on the RMB.

The Fed had intended to lend President Obama a hand as his economic stimulus plan is likely to be undermined by the Republican Party's new majority in Congress. But no one expected its 600 billion dollar quantitative easing would silence President Obama and the United States on the issue of exchange rates.

When the United States is ill, the rest of the world has to take its medicine. The Federal Reserve says quantitative easing will benefit the global economy, but it is making matters worse in an investment climate already facing a liquidity glut. It will spread risk to emerging economies like China and Brazil. And in order to relieve inflationary pressure and prevent asset bubbles, countries will have no choice but to tighten monetary policy at the expense of growth.

Two years after the outbreak of the global financial crisis, the focus of the G20 has shifted from crisis management to longer-term policy coordination. China has repeatedly said that the key to cooperation lies in maintaining unity, tackling the fundamental causes of the international financial crisis, and consolidating the momentum of world economic recovery. But the Fed split the G20 with its dollar-printing plan. And that's why President Obama found himself in the embarrassing situation of being the odd man out in Seoul.

The United States, the engine of the world economy, has damaged the economic recovery, and it is no surprise that it has met widespread criticism. Even Germany joined in the chorus of condemnation.

Indeed, one positive result to come out of the G20 Summit was that the collective condemnation may have taught the Americans a lesson and caused them to reflect on their actions.

The summit made some positive moves to damp down trade protectionism. As British Prime Minister David Cameron said, the G20 is determined to avoid a return to the era of the Great Depression when countries retreated behind trade barriers and fought currency wars.

Go to Forum >>0 Comment(s)